What to ask a Financial Advisor, and Yourself!

Take control of your finances – and your financial advisor

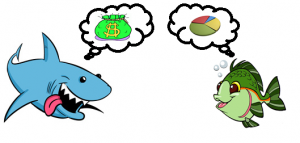

Financial advisors (independent or otherwise) might have an image of being wealthy, smug and money-grabbing but most are doing a sound job which required putting themselves through professional exams and they have to comply with all kinds of regulations too, for their clients’ protection. And if they do tend to be better paid than in many professions, we can only wonder why that is. Could it be that people’s ignorance on money matters leaves those with financial knowledge in a powerful position? Could it be that people are so fixated on money that they believe a financial advisor can make them rich(er)? I have often remarked how much more people get paid to look after people’s money than they do for looking after their children.

So, ranting over, let’s ponder: Do we need a financial advisor? Cards on the table first. I have a financial advisor. Yes, I have a pretty good idea what I want out of my savings and investments, but my financial advisor keeps me up to date with new issues, with opportunities in sectors and assets I hadn’t yet considered, with breaking news that might indicate a “sell” on a certain asset, and with knowledge about the latest tax conditions which I seem to keep forgetting. Added to all of that is a nice online platform where I can see my holdings and perform some simple analytics. In return for all that, the advisor receives commissions on transactions and a small charge for corporate actions. This is the most basic service that this particular advisor provides. For more outlay, I could get a fully managed service where the advisor has discretion to buy and sell on my behalf, having interrogated me about my aims and my risk appetite.

Do you need a financial advisor?

If someone’s financial situation is fairly simple, I would encourage them to take charge of their own finances. There are some basics that everyone should be aware of, however, and mindful this isn’t investment advice I’m giving, these are:

• If you have borrowings, then it’s usually better to pay these off first, before saving or investing.

• If you have no appetite for risk then put money into the most risk-free account you can think of, which in the UK is anything offered by National Savings and in other countries will likely be some similar government-backed scheme.

• If you need ongoing or chance access to savings and investments, don’t tie them up for a pre-defined period such as a three year bond.

• Don’t take sole advice from someone who stands to gain by selling you a particular savings or investment product.

• If a deal looks too good to be true, then it most probably is.

It might be that after considering that list, and with the knowledge you already have, that paying a financial advisor is unnecessary. For years I got by on a high interest savings account, a small number of unit trusts which my employer ran, and a FSAVC to top up my pension. I also had some shares in companies I liked, but that, admittedly, was for fun. There was no great science to the split between those assets. Indeed I can’t even recall doing any calculations. But it was good enough.

If so, stay in control

If you do decide you need further financial help, then try and avoid the trap of sitting back and letting the financial advisor ask you all the questions, some of which will be there so they can try and sell you more products. Stick to the script. It’s your money and you are, effectively, the employer here.

So what kinds of questions should you ask a financial advisor?

There are many websites which list these kinds of questions, and the FCA’s – the UK regulator’s – site is as good as any. Unlike many sites, this one goes up to 11!

Make sure you ask about fees.

Maybe you are paying your advisor up front, but there might also be fees buried inside investments that go to pay for fund management or even find their way back to the advisor through arrangements they might have with these investment companies. Check for annual charges on your investments too, which can vary a lot.

Ask about how personalised the service is.

It might be that you are batched with a number of other people who have the same profile as you. Or it might be that you are being offered a personalised service, tailored to your exact needs.

Ask about the range of investments the advisor will recommend.

If these are limited to a small number of funds from the same company, you might rightly need some convincing that a combination of these will meet your needs. You should certainly ask how well they have performed compared to their peers.

Ask yourself about your aims.

One piece of advice I can’t see anywhere is the need to be clear about your aims. Most people will say they want to make as much money as possible with as little risk as possible. Well, yes. But isn’t it more complicated than that? There will be times when losses are more sustainable. To illustrate, most of us who own our own homes accept that their value will rise and fall but in the end we will still own exactly one home, which we can use to fund a move to another home. Similarly, if we’re saving to buy property, or we have the funds from selling a property which we want to park before buying a new one, our investments could withstand a fall in value if this corresponds with a fall in property prices. After all we would expect our investments to track property prices if they rise, so the aim isn’t to gain money but to gain, or retain, purchasing power of a particular asset. Understanding one’s own investment aims is actually easier than we think, so when communicating this to a financial advisor, it’s essential that they understand these aims and explain clearly how they are proposing to structure your investments appropriately. If you don’t understand what the advisor proposes, or worse still, you don’t think the advisor understands, then go to another one. And don’t be won over by impressive-looking simulations and graphics as these can act as a smokescreen for a highly centralised operation and a dumbed-down sales force.

Be honest about your priorities

Sometimes practical considerations are important too. Do you want the financial advisor to visit your home? Do you even need to meet them periodically face-to-face? Are there local banks you have accounts with, and would like them to manage your finances too? Is a local reputation important? For me the answer is ‘no’ to all of these, but I have come across people who believe these count for a lot. And while they might not get the best deal on the street, they at least feel happy.