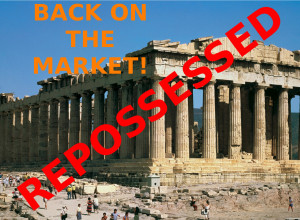

Greece debt – latest developments

The Greek government presented their plan for cutting their deficit to euro zone finance ministers today

Greek economy minister, Giorgios Stathakis, publicised the plan as a self-proclaimed “breakthrough”. But leaders from around the euro zone don’t appear to be getting overly excited just yet.

What’s in the Plan?

A lot has happened since we wrote about Greek debt last week.

The Syriza government was elected on an anti-austerity platform, so cutting the national deficit – in fact creating a surplus – couldn’t mean cutting pensions, public sector wages or any of the other measures that they promised their people they would never do. So this is what they have proposed:

- Budget surplus of 1% of GDP in year 1, 2% in year 2 and 3% in year 3.

- Increase in VAT on various goods, but not on electricity

- Increase in corporation tax from 26% to 29%

- Taxation of TV advertising, and other TV-related revenue raising measures

- Decrease in military spending

In return, they ask not only for the bailout funds to pay off their debt repayment next week, but also that their remaining outstanding debts are renegotiated over the next six months.

Obviously that’s a brief summary, but these are the main talking points. But the question remains: Is it enough?

It might be too much!

Prime Minister Alexis Tsipras and his ministers seem to have spent along time putting together a short proposal which at first sight seems to offer more than they ever looked like they would offer. Is this desperation? Or is it about buying time?

One problem is that it might be a step too far for Greek MPs elected to defend their country against austerity. There is a real danger – perhaps hard to quantify – that the proposal might be rejected in Athens, regardless of what the euro zone ministers think of it.

Another problem is one of credibility. Some reports are suggesting that there is little belief that the Greek government will actually deliver the cuts and tax increases, thereby kicking the proverbial can along the street even further.

Or not enough

Despite all the positive noises, the Athens stock exchange rising 9% and odds of 2:1 against a “Grexit” in 2015, the dust is still settling. Jeroen Dijsselbloem, chairman of the Eurogroup of 19 euro zone finance ministers, went no further than saying the proposal is “a basis to really restart the talks”. Comments from Germany are more downbeat, with Wolfgang Schaeuble saying he “had seen nothing new from Athens”.

But it’s not all gloom. Jean-Claude Juncker said “We will get a deal this week. Categorical.”

Is this the endgame

It appears that the convergence of will, which some like Money Questioner has previously predicted, is happening. There is simply too much to lose for everyone that not doing a deal of some kind is the worst outcome. It’s clear that Greece will never pay its debts and a settlement must be agreed for the benefit of both sides. But as this is more political than a simple payday loan or even a mortgage, powerful people want to see the bailout happen – just not at any cost.