Everything’s a Buy as Central Banks Keep on Greasing Markets

Misery is making strange bedfellows in global markets.

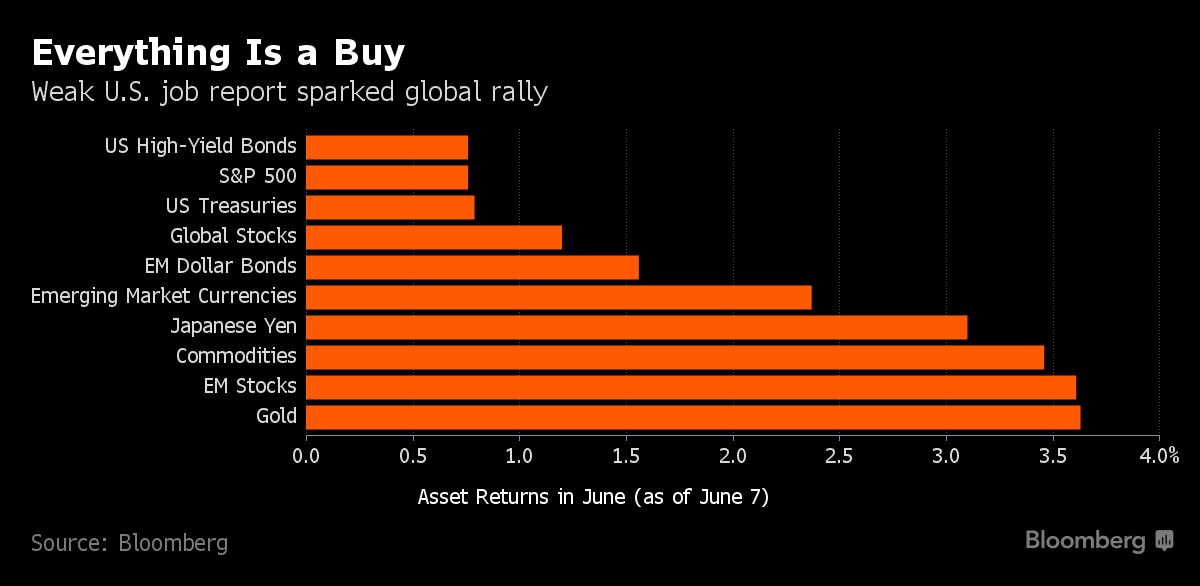

At a time when risky assets including stocks, commodities, junk bonds and

emerging-market currencies are rallying to multi-month highs, so are the havens, from gold, government bonds to the Swiss franc and the Japanese yen.

No matter that the U.S. labor market is deteriorating and the World Bank has just cut its estimates for global economic growth. Investors either don’t believe the news is bad enough to kill a global recovery that’s already long in the tooth, or they’re betting that sluggishness in some of the biggest economies means central banks will stay more accommodative for longer.

Full story on Bloomberg

Trading volatility

The report states that “Shares outstanding in exchange-traded notes betting on an increase in the VIX are at all-time highs.” VIX is the index calculated using an option pricing model that connects implied volatility to put and call option prices.It’s for the US equity market. In language that most normal people speak, it measures how much traders exect the market to be volatile in the near future – or how much uncertainty there is around. Currently volatility is low bu historic standards, and buying into VIX is really buying into increased uncertainty. It’s a hedge, really, for those who enjoy the rally but are getting nervous about its sustainability.

Correlation

The report also states that asset classes are too highly correlated just now. Everything seems to be rising together, like mountain climbers joined by ropes. The danger is that when one falls, they all fall!