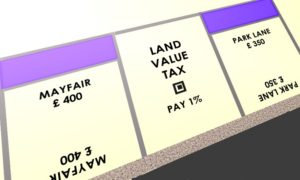

Land Value Tax – 7 myths busted

Land Value Tax is starting to gain traction, but should you believe all the criticisms of it?

As with all new ideas, some will attempt to abort Land Value Tax (LVT) before birth, none so more than the Conservative Party. Despite being championed by economists as diverse as Milton Friedman, Henry George and Joseph Stiglitz, LVT has never had a comfortable place on the political spectrum, with many assuming it’s a product of the opposite side. To illustrate this, land reform campaigner and Scottish Green party MSP Andy Wightman channels Winston Churchill in his paper on LVT which is well worth a read.

The landlord who happened to own a plot of land on the outskirts or at the centre of one of our great cities …. sits still and does nothing. Roads are made, streets are made, railway services are improved, electric light turns night into day, electric trams glide swiftly to and fro, water is brought from reservoirs a hundred miles off in the mountains – and all the while the landlord sits still… To not one of these improvements does the land monopolist as a land monopolist contribute, and yet by every one of them the value of his land is sensibly enhanced.

Winston Churchill 1909

(follow previous link for reference)

So here are seven ways people have mis-represented LVT, along with some clarification from me.

1. Why should I have to pay tax on money that’s already been taxed?

We’re so used to thinking of tax as income tax, we sometimes forget that it’s not money that’s being taxed but people. Besides many taxes double-up. Our taxed income also pays VAT, for example.

But why should tax be concentrated on income? Why not on wealth – a more true measure of ability to pay? LVT only partly represents a person’s wealth but there are good reasons why it’s promoted as a proxy, notably that it’s the part of an owner’s wealth than can’t be moved away from the national jurisdiction. It’s worth pointing out that LVT shouldn’t be thought of as some kind of sneaky additional piece of taxation. Its introduction should be tax neutral, thereby leading to cuts elsewhere (such as lowering income tax).

2. It’s a Garden Tax

The “garden tax” label was quickly introduced by those opposing UK Labour’s passing mention of LVT in their 2017 manifesto, in particular the right wing press with articles like this, based on Conservative Party spin. And perhaps Labour’s ideas will lead to little more than a revamped council tax, where the price or rental value of the property is included. The IEA, on the other hand, propose starting LVT on non-residential property, thereby encouraging more business-efficient use of land. While it’s hard to get away from some kind of proportionality between size of land and tax paid, gardens are “unimproved land” and therefore don’t attract the same value as similarly sized plots with houses on them. Put differently, two identical houses in the same street with different sized gardens are likely to command similar sale prices. However if you get permission to build a second house in your garden, expect to pay more LVT!

3. It’s another tax on the rich

For a number of people, this might be a positive. But a lot depends on government policy. My own preference is for something like a flat rate of income tax plus LVT, getting rid of stamp duty too (a peculiar UK tax on moving home). This means the emphasis is not so much on taxing high income but on high wealth, particularly land wealth which was labelled by economist David Ricardo “that portion of the produce of the earth which is paid to the landlord for the use of the original and indestructible powers of the soil”. So yes, a tax on the rich, but only those who are rich because of rising land prices, in turn attributable to improvements to the surrounding areas, not through the fruits of their own labour. Governments can progressively tax high earners or it can fairly tax the wealthy. Be suspicious if your government wants to tax both.

4. It’s complicated to administer, and easy to avoid

Let’s bust the second first. Of all taxes, it’s probably the most difficult to avoid. For every square metre of land, there will (if the will is there) be a tax charge. Whether than land is a hotel, a country estate, a church, a hill, a rock, a road or a park. State-owned land will likely be exempt as the state can hardly tax itself. But there will be a notional LVT arising, perhaps encouraging governments too, to make better use of land or, indeed, sell land attracting high LVT. Farms might require special treatment too, given how land-intensive they are. But given farm land is cheap compared to residential land, that may not be an issue. Unless as one commentator points out, you might be growing turnips in Surrey.

With modern tools and techniques, and I’m thinking of Google Maps here, it should be easy enough to assign every square metre of land to an owner and to put a value on it. Yes, there will be approximations and miscalculations, there always is with tax, but regardless of whether the owner is an individual, a business or an offshore trust, all will have to pay.

5. It’s my land, why should I perpetually pay the state for it?

It’s your land is it? Because there’s a title deed with a meaning upheld in national law? Consider what happens if there’s a revolution or if the country is invaded. What use is that title deed after that? Ownership of the land is granted by the state, which in a democracy means all of us. So we all grant an individual or business to own (or occupy) a piece of land. It follows logically that the owner of the land should be required to pay for that privilege to the rest of us, which is what LVT achieves. An added bonus is that this scheme reduces inequality. Think of a game of Monopoly where players have to redistribute a small portion of their wealth each turn. It would make the game go on for ever!

6. It’s unfair to elderly people with little income

If elderly people want to stay in large homes (perhaps moving isn’t an option) then that should be fine. I wouldn’t expect their homes to be repossessed because they can’t pay LVT. But I do expect unpaid LVT to accrue and be paid on death. This rule should only apply to individuals. Owners that don’t die, like businesses and offshore trusts, should expect to pay each year.

7. It’s a socialist idea and should be rejected!

The surprising thing is that while the left-leaning UK Labour party is considering embracing LVT, it’s right wing think tanks like the IEA and the Adam Smith Institute that promote it. Tim Worstall of the ASI echoes many of my arguments, adding that LVT encourages the most productive use of the land in question. Milton Friedman called it “The least bad tax”.

Some parties, such as the UK Green Party, advocate replacing council tax with LVT. Their model sees local authorities setting LVT rates. But that’s essentially a way of lifting the cap on council tax that sees millionaires pay the same as billionaires. UK Labour haven’t set their stall out on LVT yet, but their thinking is likely to be similar. Left wing think tank The Fabians take a wider view, and recognise that inequalities of wealth are far greater tan inequalities of income in their discussion on the merits of LVT. If left wing organisations can bring themselves to stop chasing income and start taxing wealth, then the two sides of the political debate would be dangerously congruent, with just the Conservative Party (currently in government, just) out of kilter with everyone else. No prizes for guessing which party wealthy landowners support.

In conclusion

I make no apologies that I continue to promote Land Value Tax on this site. Land is a resource in limited supply that is ultimately owned by the nation. The more someone occupies it, and benefits from local infrastructure improvements and rising demand, the more they should compensate the rest of us for it. That sounds Marxist, but in fact it’s right wing economists and politicians that have come out in favour of it more radically than left wingers, who are generally slower to shift from raising existing taxes like income tax, corporation tax and council tax. The Conservative Party are slower still, and we can only conjecture why that might be.

Finally, this video from Dominic Frisby explains in a few minutes what I’ve spent the last couple of years blogging about.

Brilliant list, thanks

What exactly is it people are arguing against?

The LVT is merely the way be which we equally share the scarcity values derived from resources supplied for free by nature/God.

If we don’t equally share those scarcity values, because Land is irreproducible, inequality and dysfunction are baked into our economies and our societies.

Just to put things into perspective, when people say they don’t want LVT, inequality and dysfunction are what they are arguing for.

Not necessarily.It needs to be a lot more nuanced or land use will sink to the lowest common denominator what will happen to organic farmers for example?you can’t be a Marxist and quote Friedman either

Nothing will happen to organic farmers. They will pay LVT like anyone else. They will pay ‘zero’ tax on buildings. And , depending on what level of LVT is implemented, pay lees to zero income tax.

Socially Just Taxation and Its Effects (17 listed)

Our present complicated system for taxation is unfair and has many faults. The biggest problem is to arrange it on a socially just basis. Many companies employ their workers in various ways and pay them diversely. Since these companies are registered in different countries for a number of categories, the determination the criterion for a just tax system becomes impossible, particularly if based on a fair measure of human work-activity. So why try when there is a better means available, which is really a true and socially just method?

Adam Smith (“Wealth of Nations”, 1776) says that land is one of the 3 factors of production (the other 2 being labor and durable capital goods). The usefulness of land is in the price that tenants pay as rent, for access rights to the particular site in question. Land is often considered as being a form of capital, since it is traded similarly to other durable capital goods items. However it is not actually man-made, so rightly it does not fall within this category. The land was originally a gift of nature (if not of God) for which all people should be free to share in its use. But its site-value greatly depends on location and is related to the community density in that region, as well as the natural resources such as rivers, minerals, animals or plants of specific use or beauty, when or after it is possible to reach them. Consequently, most of the land value is created by man within his society and therefore its advantage should logically and ethically be returned to the community for its general use, as explained by Martin Adams (in “LAND”, 2015).

However, due to our existing laws, land is owned and formally registered and its value is traded, even though it can’t be moved to another place, like other kinds of capital goods. This right of ownership gives the landlord a big advantage over the rest of the community because he determines how it may be used, or if it is to be held out of use, until the city grows and the site becomes more valuable. Thus speculation in land values is encouraged by the law, in treating a site of land as personal or private property—as if it were an item of capital goods, although it is not (Mason Gaffney and Fred Harrison: “The Corruption of Economics”, 2005).

Regarding taxation and local community spending, the municipal taxes we pay are partly used for improving the infrastructure. This means that the land becomes more useful and valuable without the landlord doing anything—he/she will always benefit from our present tax regime. This also applies when the status of unused land is upgraded and it becomes fit for community development. Then when this news is leaked, after landlords and banks corruptly pay for this information, speculation in land values is rife. There are many advantages if the land values were taxed instead of the many different kinds of production-based activities such as earnings, purchases, capital gains, home and foreign company investments, etc., (with all their regulations, complications and loop-holes). The only people due to lose from this are those who exploit the growing values of the land over the past years, when “mere” land ownership confers a financial benefit, without the owner doing a scrap of work. Consequently, for a truly socially just kind of taxation to apply there can only be one method–Land-Value Taxation.

Consider how land becomes valuable. New settlers in a region begin to specialize and this improves their efficiency in producing specific goods. The central land is the most valuable due to easy availability and least transport needed. This distribution in land values is created by the community and (after an initial start), not by the natural resources. As the city expands, speculators in land values will deliberately hold potentially useful sites out of use, until planning and development have permitted their values to grow. Meanwhile there is fierce competition for access to the most suitable sites for housing, agriculture and manufacturing industries. The limited availability of useful land means that the high rents paid by tenants make their residence more costly and the provision of goods and services more expensive. It also creates unemployment, causing wages to be lowered by the monopolists, who control the big producing organizations, and whose land was already obtained when it was cheap. Consequently this basic structure of our current macroeconomics system, works to limit opportunity and to create poverty, see above reference.

The most basic cause of our continuing poverty is the lack of properly paid work and the reason for this is the lack of opportunity of access to the land on which the work must be done. The useful land is monopolized by a landlord who either holds it out of use (for speculation in its rising value), or charges the tenant heavily for its right of access. In the case when the landlord is also the producer, he/she has a monopolistic control of the land and of the produce too, and can charge more for this access right than what an entrepreneur, who seeks greater opportunity, normally would be able to afford.

A wise and sensible government would recognize that this problem derives from lack of opportunity to work and earn. It can be solved by the use of a tax system which encourages the proper use of land and which stops penalizing everything and everybody else. Such a tax system was proposed 136 years ago by Henry George, a (North) American economist, but somehow most macro-economists seem never to have heard of him, in common with a whole lot of other experts. (I would guess that they don’t want to know, which is worse!) In “Progress and Poverty” 1879, Henry George proposed a single tax on land values without other kinds of tax on produce, services, capital gains etc. This regime of land value tax (LVT) has 17 features which benefit almost everyone in the economy, except for landlords and banks, who/which do nothing productive and find that land dominance has its own reward.

17 Aspects of LVT Affecting Government, Land Owners, Communities and Ethics

Four Aspects for Government:

1. LVT, adds to the national income as do other taxation systems, but it replaces them.

2. The cost of collecting the LVT is less than for all of the production-related taxes–tax avoidance becomes impossible because the sites are visible to all.

3. Consumers pay less for their purchases due to lower production costs (see below). This creates greater satisfaction with the management of national affairs.

4. The national economy stabilizes—it no longer experiences the 18 year business boom/bust cycle, due to periodic speculation in land values (see below).

Six Aspects Affecting Land Owners:

5. LVT is progressive–owners of the most potentially productive sites pay the most tax.

6. The land owner pays his LVT regardless of how his site is used. A large proportion of the ground-rent from tenants becomes the LVT, with the result that land has less sales-value but a significant “rental”-value (even when it is not used).

7. LVT stops speculation in land prices and the withholding of land from proper use is not worthwhile.

8. The introduction of LVT initially reduces the sales price of sites, even though their rental value can still grow over a longer term. As more sites become available, the competition for them is less fierce.

9. With LVT, land owners are unable to pass the tax on to their tenants as rent hikes, due to the reduced competition for access to the additional sites that come into use.

10. With LVT, land prices will initially drop. Speculators in land values will want to foreclose on their mortgages and withdraw their money for reinvestment. Therefore LVT should be introduced gradually, to allow these speculators sufficient time to transfer their money to company-shares etc., and simultaneously to meet the increased demand for produce (see below).

Three Aspects Regarding Communities:

11. With LVT, there is an incentive to use land for production or residence, rather than it being unused.

12. With LVT, greater working opportunities exist due to cheaper land and a greater number of available sites. Consumer goods become cheaper too, because entrepreneurs have less difficulty in starting-up their businesses and because they pay less ground-rent–demand grows, unemployment decreases.

13. Investment money is withdrawn from land and placed in durable capital goods. This means more advances in technology and cheaper goods too.

Four Aspects About Ethics:

14. The collection of taxes from productive effort and commerce is socially unjust. LVT replaces this extortion by gathering the surplus rental income, which comes without any exertion from the land owner or by the banks– LVT is a natural system of national income-gathering.

15. Bribery and corruption on information about land cease. Before, this was due to the leaking of news of municipal plans for housing and industrial development, causing shock-waves in local land prices (and municipal workers’ and lawyers’ bank balances).

16. The improved use of the more central land reduces the environmental damage due to a) unused sites being dumping-grounds, and b) the smaller amount of fossil-fuel use, when traveling between home and workplace.

17. Because the LVT eliminates the advantage that landlords currently hold over our society, LVT provides a greater equality of opportunity to earn a living. Entrepreneurs can operate in a natural way– to provide more jobs. Then earnings will correspond to the value that the labor puts into the product or service. Consequently, after LVT has been properly introduced it will eliminate poverty and improve business ethics.

TAX LAND NOT LABOR; TAX TAKINGS NOT MAKINGS!

Excellent list and post David.

LVT says that you own land so pay for my expenses how is that moral?

LVT causes people to not fully use land because then the value will increase and they will pay more taxes.

Wealth is always and advantage and there is nothing wrong with that.

It is not governments job to protect environment, tree hugging hippie greenism shouldn’t be something government force on others.

WThe collection of taxes just because you own something is unjust.What is more unjust is that you have to pay more if it becomes more valuable out of your control.

If I own something why should I pay taxes for it?LVT is the first plank of marxism.Government owns all land and it is rented by government.

Why should we incentive on how we should use our land.Why can’t I do whatever I want with my land??

Land is also capital.LVT deincentive people from using land because they have to pay for other peoples expenses while using it.

Any progressive tax is bad tax.If owners of the most productive pay the most then you deincentive people from being as productive as possible.

Yes when you tax something it drops in demand because people don’t wanna pay for others expenses.

So Im gonna pay for others expenses just because I own land.

No it increases production costs since you have to own land to produce and thus there is less incentive to open a factory.

This is no different than sales tax or income tax.You want other people to pay for your expenses because it benefits you in this system.

5th reason would only make sense if the land was owned by government and people who use it rented but no the land is owned by me and if someone tries to take it away because I don’t pay them a fee than that is just like first plank of marxism.

http://laissez-fairerepublic.com/TenPlanks.html

Anything you own can be taken away if there is a revolutuion or an invasion not just land.

You sound a lot like a marxist in the conculusion aswell.”You own stuff so pay for our expenses”

Anything is a limited supply.There is limited amount of mass and energy.

Land value tax has always been supported by far leftists(progressives)

https://www.conservapedia.com/Land_value_tax